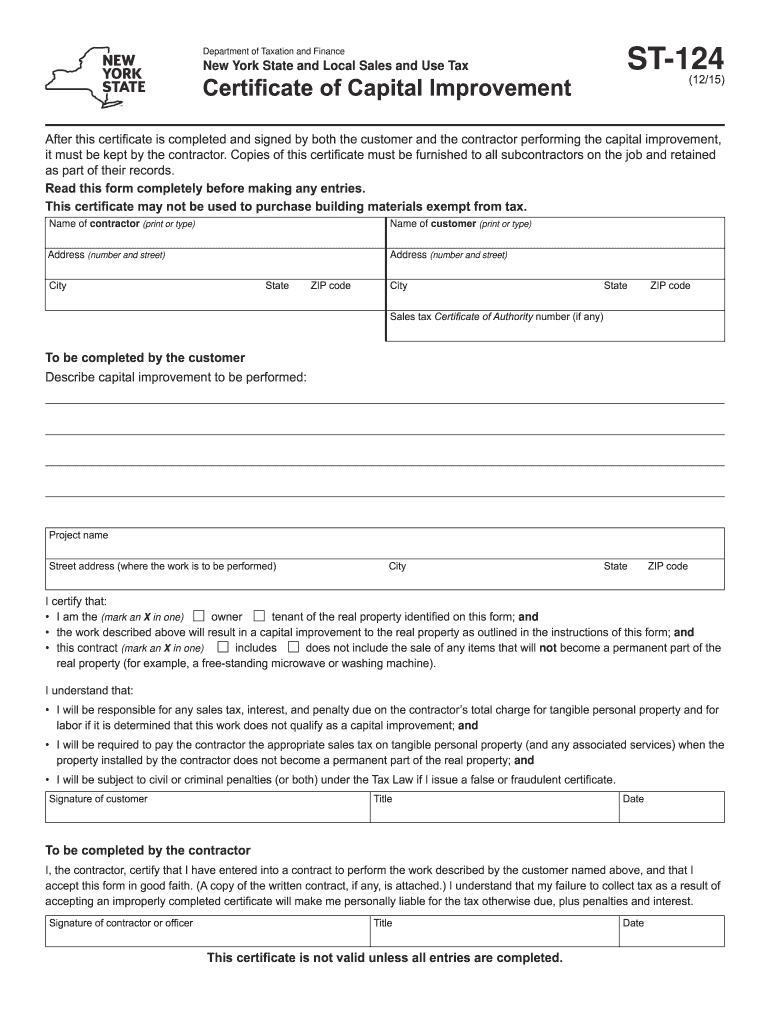

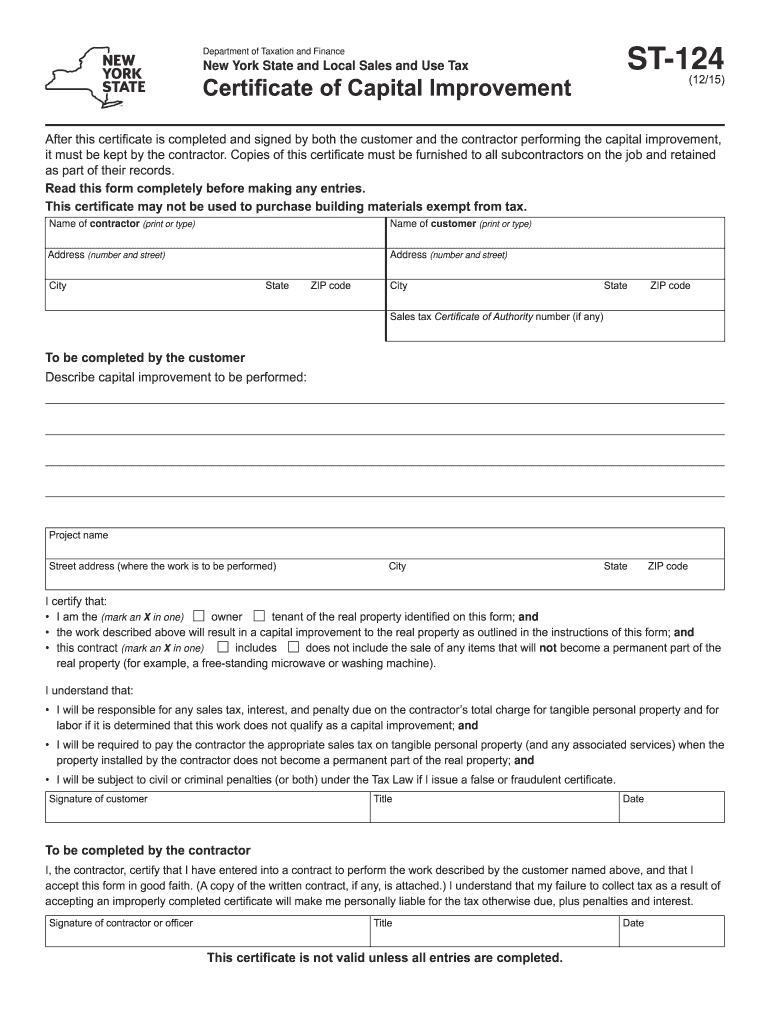

NY DTF ST-124 2015-2024 free printable template

Get, Create, Make and Sign

How to edit capital improvement form online

NY DTF ST-124 Form Versions

How to fill out capital improvement form 2015-2024

How to fill out st 124:

Who needs st 124:

Video instructions and help with filling out and completing capital improvement form

Instructions and Help about capital improvement certificate new york form

Call the Scottsboro city council meeting than they like me to order engaging in the money belongs from pledge allegiance get my gear soon let's pray Heavenly Father to become before you this evening we give you thanks and praise for the opportunities that you lay out before us, we invite you here among us, we lift your name we thank you again for the opportunity to make conscious decisions where it's concerning the city of Scottsboro we actually blessings over this city over its citizens over its workers and its leaders, so your pressure slightly front again politically divided in the United States of America and to the Republic for which it stands one nation under God indivisible with liberty and justice for all their facility local is Mr. Stan do is join senator Mr. Harry sir your Mr. Miller here is your Patrick's in here we'll go to the gym of emotion about the agenda set foot in session no fair say they found Thomas approval grievousness which Lila 2016 emotions make a mousse I say so discussion they're so hot there is no business will go to business he first times consider resolution relation without opposition presenting certification of election without a resolution to approve we also have a life of it certified this distance our Father in one person filed a second of candidacy for the office of meeting council of ice number 2 5pm there Tuesday Angela preceding between third day of always to 2016 today except regulation of municipal officers in the city of South Carolina and nine postage version his subjects to earth secondly we have a resolution you have a copy motion to approve this resin breakfast ok so in education here you know how to die per se I this is our certificate of election, and I've never understood how you guys coming over the hose not on a free cousin have to have opposition every time it doesn't seem fair, but this is to advise you that city council of the city of stuff bro Alabama has here for declare that you were duly elected to the office of place number two on the Scottsboro City Council you to note opposition having legally qualified against you in the election to be held in and for the city of Scottsboro nearly done on this the 25th day of July 2016 and this is your official certificate of election to such ops congratulations these items discussed voters build revelations Christine work, although there are questions asked for any questions and firm sorry okay it's all over there was several weeks ago maybe put a deal on my ear about adding the same guitar to the concession stand and I know since can look into that promise out to con give us some idea what is going to take to get into the second level also understand the project went out to be in which we're supposed to be able to come on was it wasn't right though it's just a low spot yeah to the same and as far as I know his life in prison not we two minds ramp up the office of you because we are able to presenting in the group as far as the council go so project...

Fill st 124 example : Try Risk Free

People Also Ask about capital improvement form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your capital improvement form 2015-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.